steamboat springs colorado sales tax rate

Sales Use Tax Sales tax is due at the time of titling. The average cumulative sales tax rate in Steamboat Springs Colorado is 84.

Washington Sales Tax Rates By City

This is the total of state county and city sales tax rates.

. The Colorado sales tax rate is 29 the sales tax rates in cities may differ from 325 to 104. Tax Jurisdiction Tax Rate State of Colorado 29 Routt County 10 City of Steamboat Springs 45 Total combined sales tax rate inside the City 84 Documentation providedoutside City no permits or certificates84 39 County building permits74 29 City building permits29 29 sales tax licenses00 00 exemption certificates00 00. Within Steamboat Springs there are around 2 zip codes with the most populous zip code being 80487.

Steamboat Springs is in the following zip codes. Select the Colorado city from the list of cities starting with S below to see its current sales tax rate. You can print a 84 sales tax table here.

City of Steamboat Springs. You can find more tax rates and allowances for Steamboat Springs and. The combined amount is 820 broken out as follows.

Steamboat Springs in Colorado has a tax rate of 84 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Steamboat Springs totaling 55. Total Combined Tax Rate 114 29 State of Colorado 10 Routt County and if applicable 20 Local Marketing District tax is remitted to the State. VEHICLE USE TAX Steamboat Springs vehicle use tax is levied on all automotive vehicles mobile machinery and self-propelled construction equipment for use or storage within the City of Steamboat Springs.

This program will process sales tax licenses returns and payment as well as business license applications and renewals. Live in Routt County. The Colorado sales tax rate is currently.

Live in Steamboat Springs. The state sales tax rate in Colorado is 2900. Martin Dragnev COLORADO GROUP REALTY.

Buyer and seller both in Hayden. Higher sales tax than 84 of Puerto Rico localities -45 lower than the maximum sales tax in The 84 sales tax rate in Steamboat Springs consists of 29 Puerto Rico state sales tax 1 Routt County sales tax and 45 Steamboat Springs tax. 45 City of Steamboat Springs sales tax and 10 Accommodations tax is collected on all taxa- ble transactions and is remitted to the City of Steamboat Springs.

Town Sales Tax Rate 45 effective January 1 2016 Notice to Business Owners Effective January 1 2016 Crested Butte began using a paperless licensing and tax remittance system MUNIRevs. Colorado Springs CO Sales Tax Rate The current total local sales tax rate in Colorado Springs CO is 8200. He instead supports a 075 increase in the citys sales tax and a 2 tax on lodging across the board.

What is the sales tax rate in Steamboat Springs Colorado. There is no applicable special tax. Colorado Springs is in the following zip codes.

The sales tax rate does. 15 Sequoia Ct Steamboat Springs CO 80487. You can print a 84 sales tax table here.

City of Steamboat Springs. Steamboat Springs city officials received petitions on Thursday July 21 seeking to recall three City Council members along with a referendum to repeal an ordinance that would put a 9 tax on short-term rentals on the November ballot. Lessors Anyone renting or leasing tangible personal property.

Did South Dakota v. Excise tax is levied at a rate of 12 of the construction value and is collected through the building permit process. Steamboat Springs is located within Routt County Colorado.

307 City of Colorado Springs self-collected 200 General Fund 010 Trails Open Space and Parks TOPS. Colorado has recent rate changes Fri Jan 01 2021. Method to calculate Steamboat Springs sales tax in 2021 As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

The Steamboat Springs sales tax rate is. Homes similar to 38 Sequoia Ct are listed between 399K to 2750K at an average of 670 per square foot. Legal Address Tax Percentage.

The current total local sales tax rate in Steamboat Springs CO is 8400. Sales Tax Breakdown Steamboat Springs Details Steamboat Springs CO is in Routt County. Motor Vehicle Title Registration Resources.

Authorized as legal public units theyre controlled by elected officials or appointed officers. Sales Tax Breakdown Colorado Springs Details Colorado Springs CO is in El Paso County. Buyer and seller both in Oak Creek.

Who Needs a Sales Tax License. Effective January 1 2021 the City of Colorado Springs sales and use tax rate has decreased from 312 to 307 for all transactions occurring on or after that date. Leased or rented at Retail and not subjected to the Steamboat Springs Sales.

The December 2020 total local sales tax rate was 8250. 80901 80902 80903. The December 2020 total local sales tax rate was also 8400.

The average sales tax rate in Colorado is 6078. Retailers Anyone engaged in the business of making retail sales. There is no applicable special tax.

State of Colorado. While Colorado law allows municipalities to collect a local option sales tax of up to 42 Steamboat Springs does not currently collect a local sales tax. With local taxes the total sales tax rate is between 2900 and 11200.

For tax rates in other cities see Colorado sales taxes by city and county. The Steamboat Springs Colorado sales tax is 290 the same as the Colorado state sales tax. 80477 80487 80488.

Under Colorado law the government of Steamboat Springs public hospitals and thousands of various special purpose units are given authority to estimate real estate market value determine tax rates and assess the tax. Examples include ski rentals DVDs vehicles. The minimum combined 2022 sales tax rate for Steamboat Springs Colorado is.

25 lower than the maximum sales tax in CO The 84 sales tax rate in Steamboat Springs consists of 29 Colorado state sales tax 1 Routt County sales tax and 45 Steamboat Springs tax. The Steamboat Springs sales tax rate is 45 Steamboat Springs accommo- dations tax rate is 1 of the retail purchase price. The County sales tax rate is.

This includes the sales tax rates on the state county city and special levels.

2021 Sales Tax Reports Show Spending In Summit County Has Returned To Pre Pandemic Levels Summitdaily Com

2021 Sales Tax Reports Show Spending In Summit County Has Returned To Pre Pandemic Levels Summitdaily Com

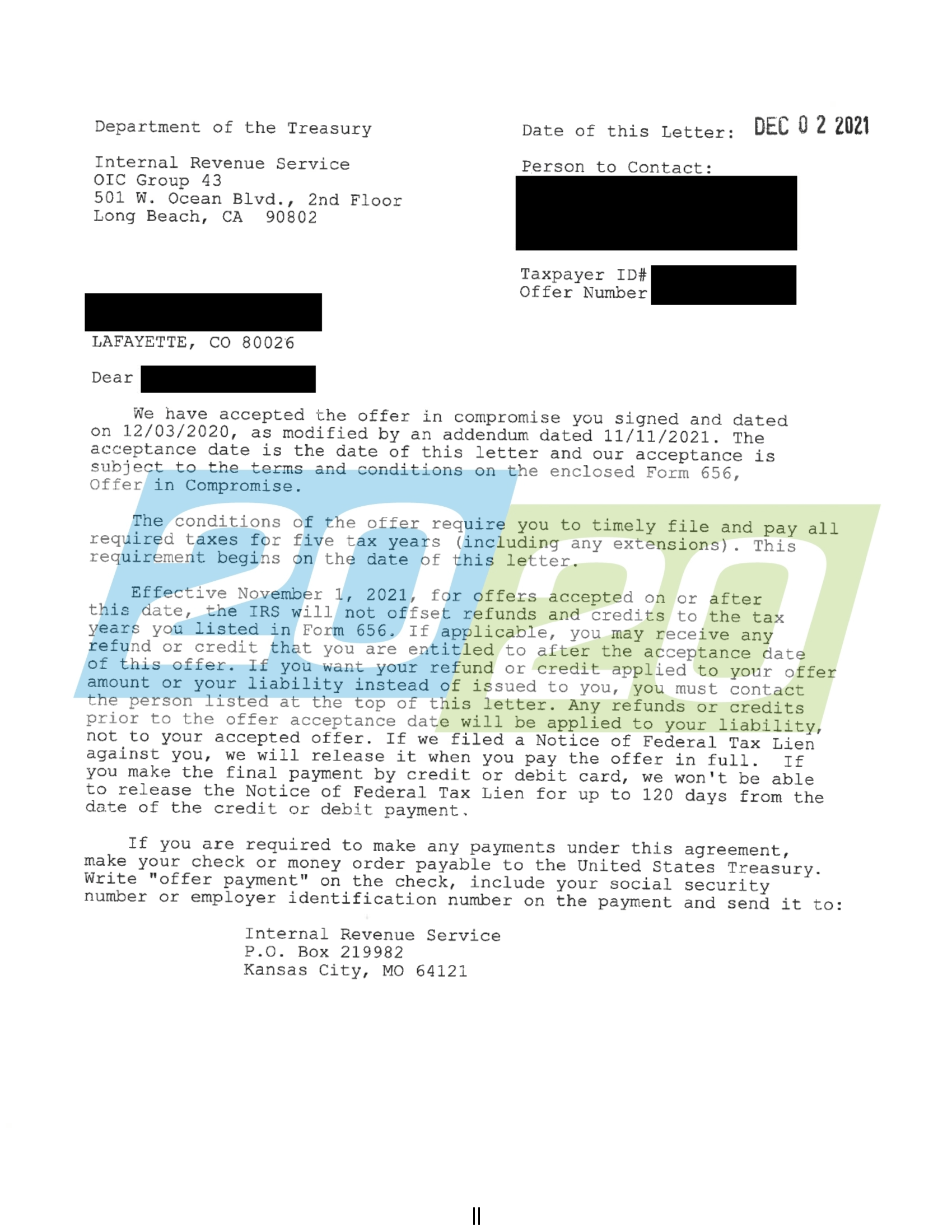

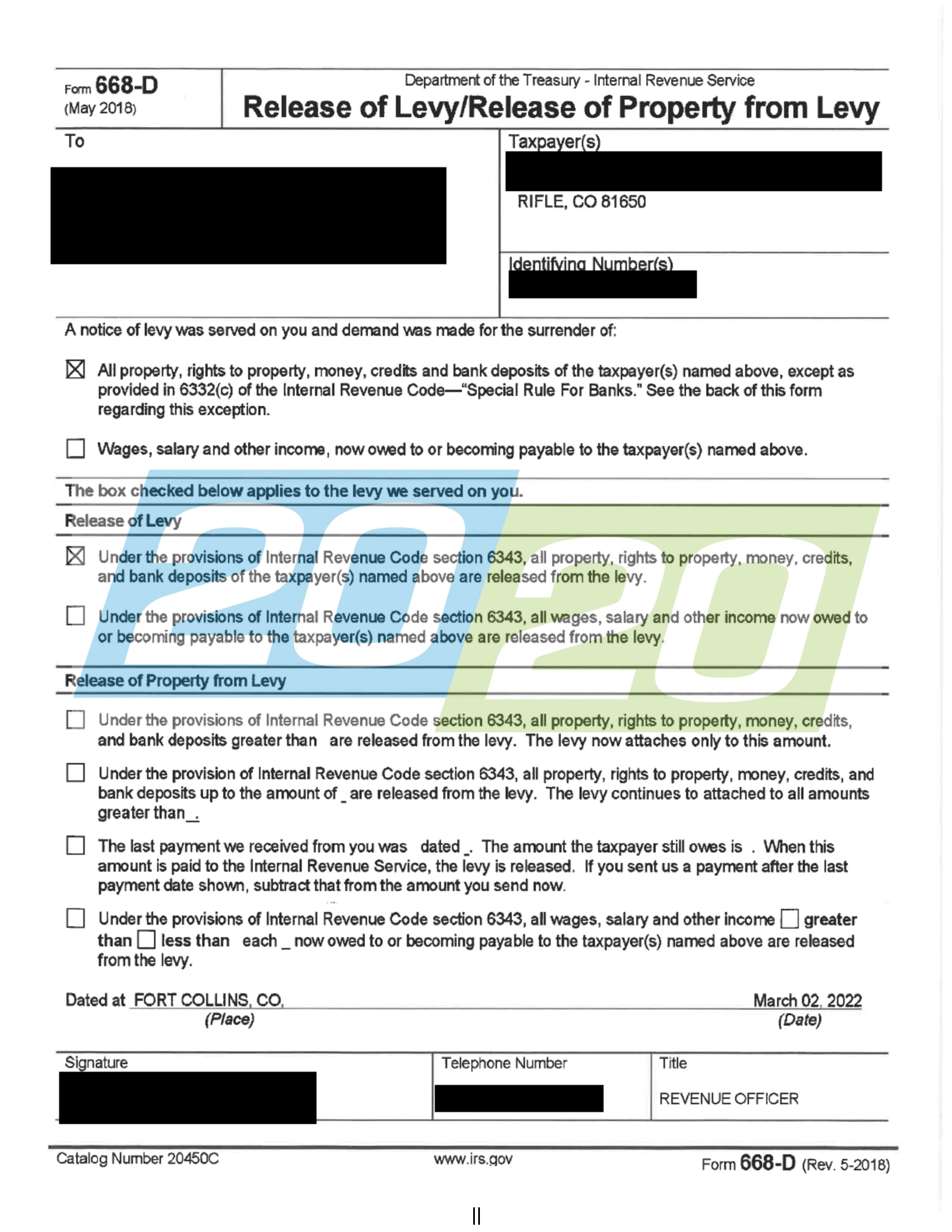

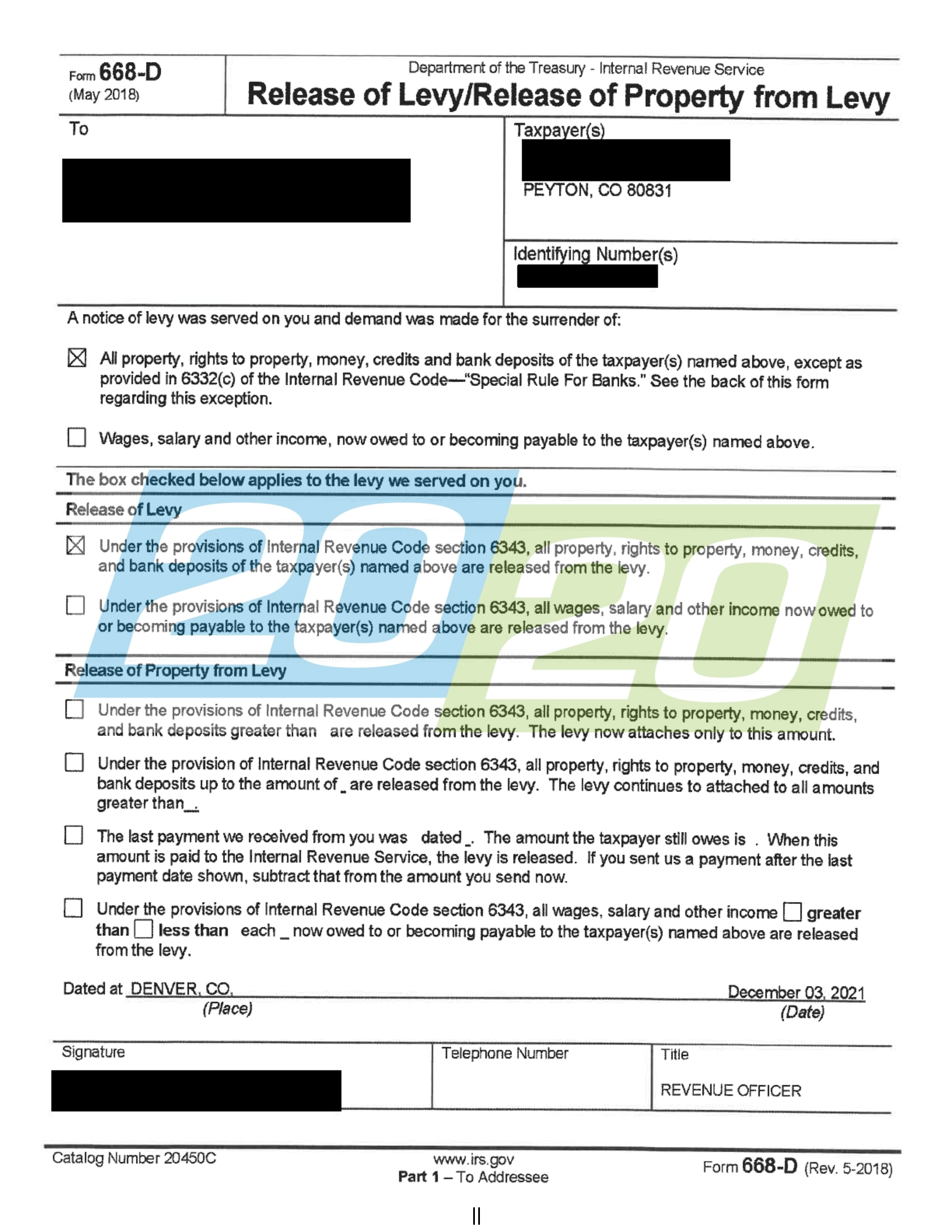

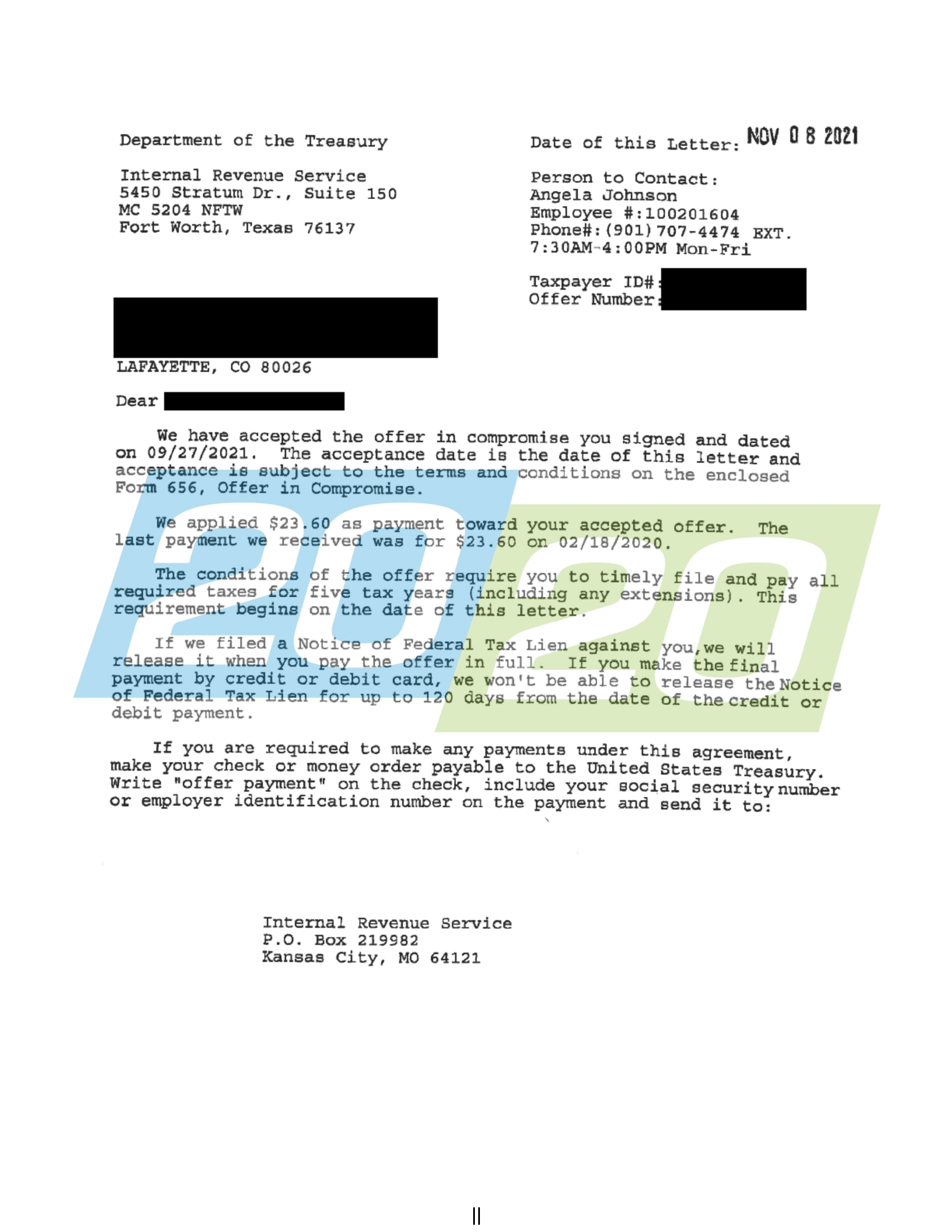

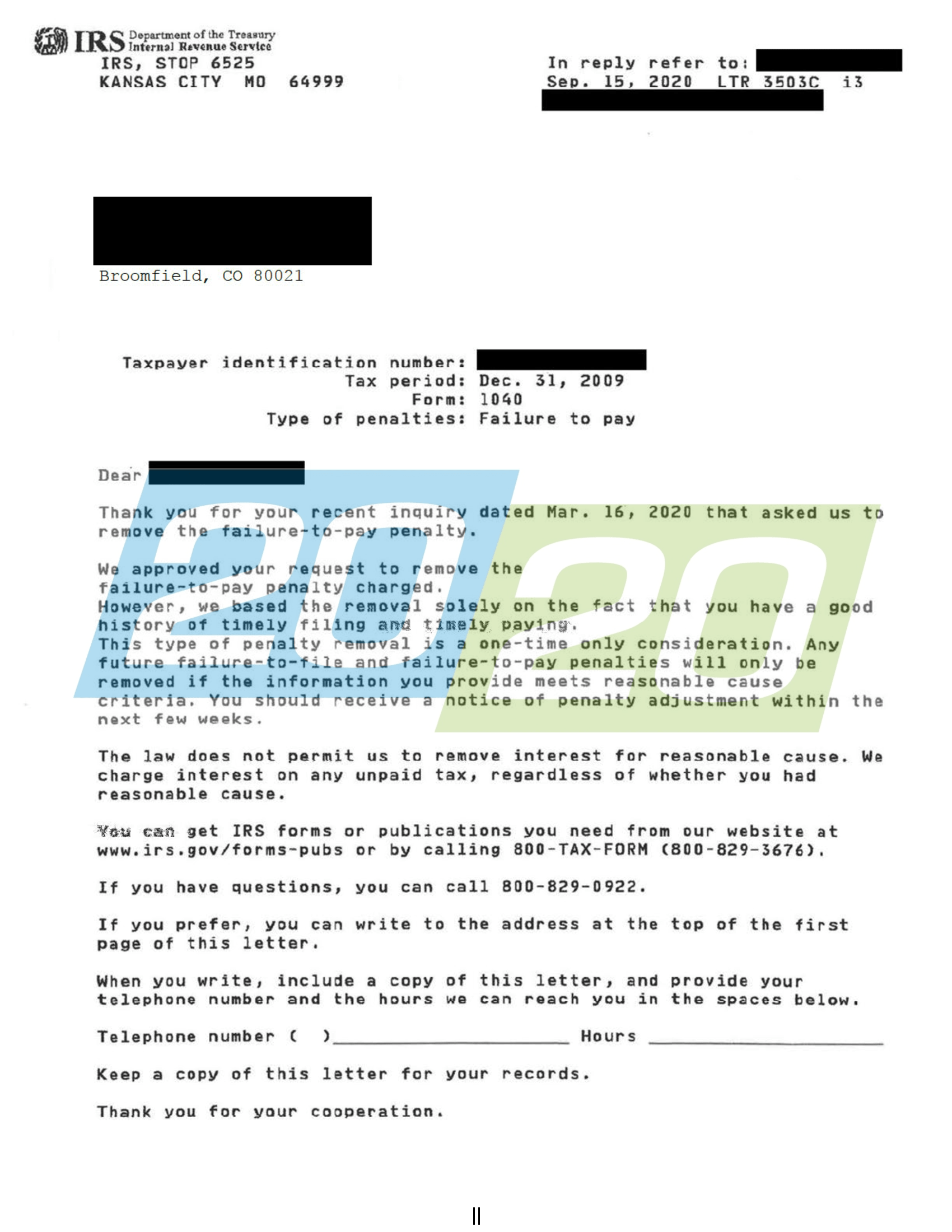

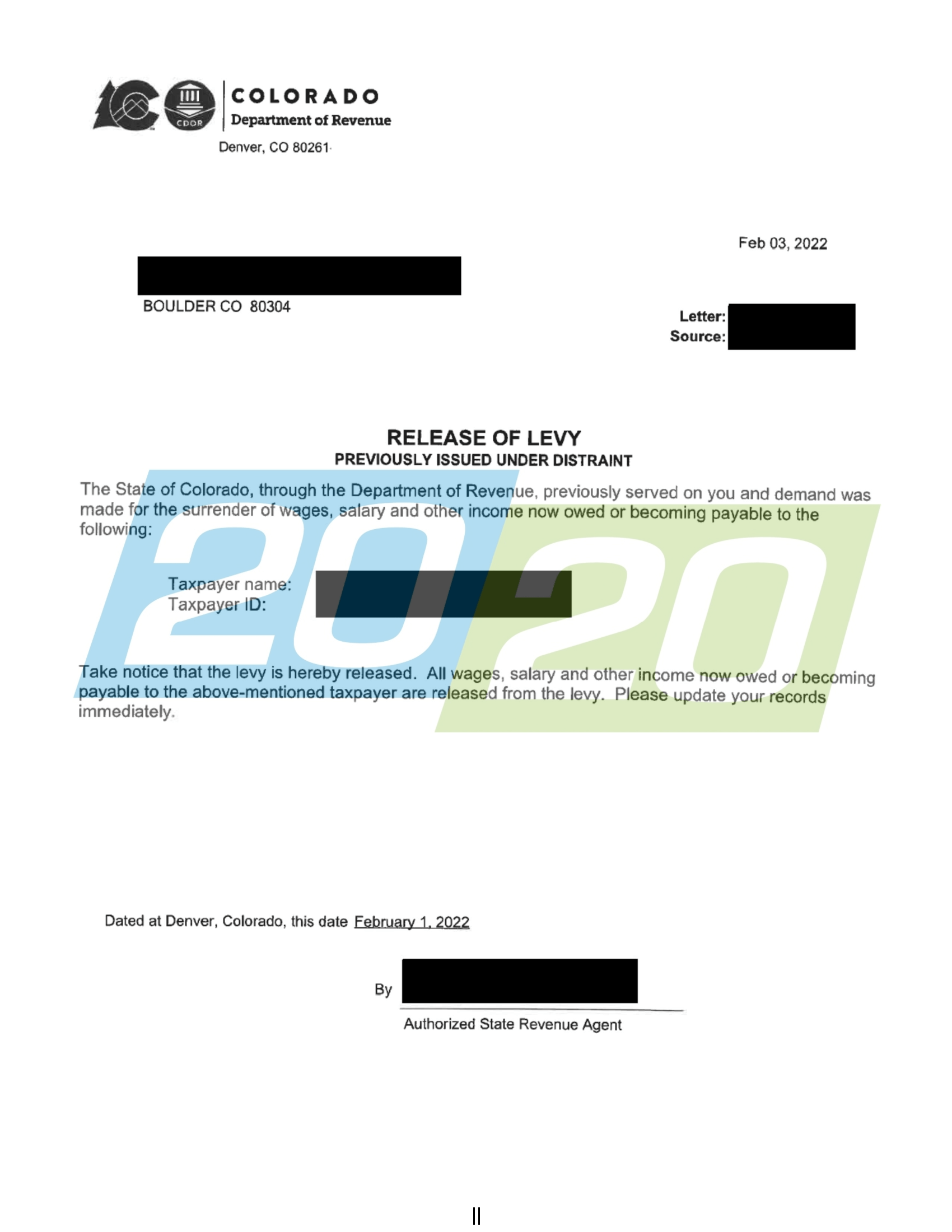

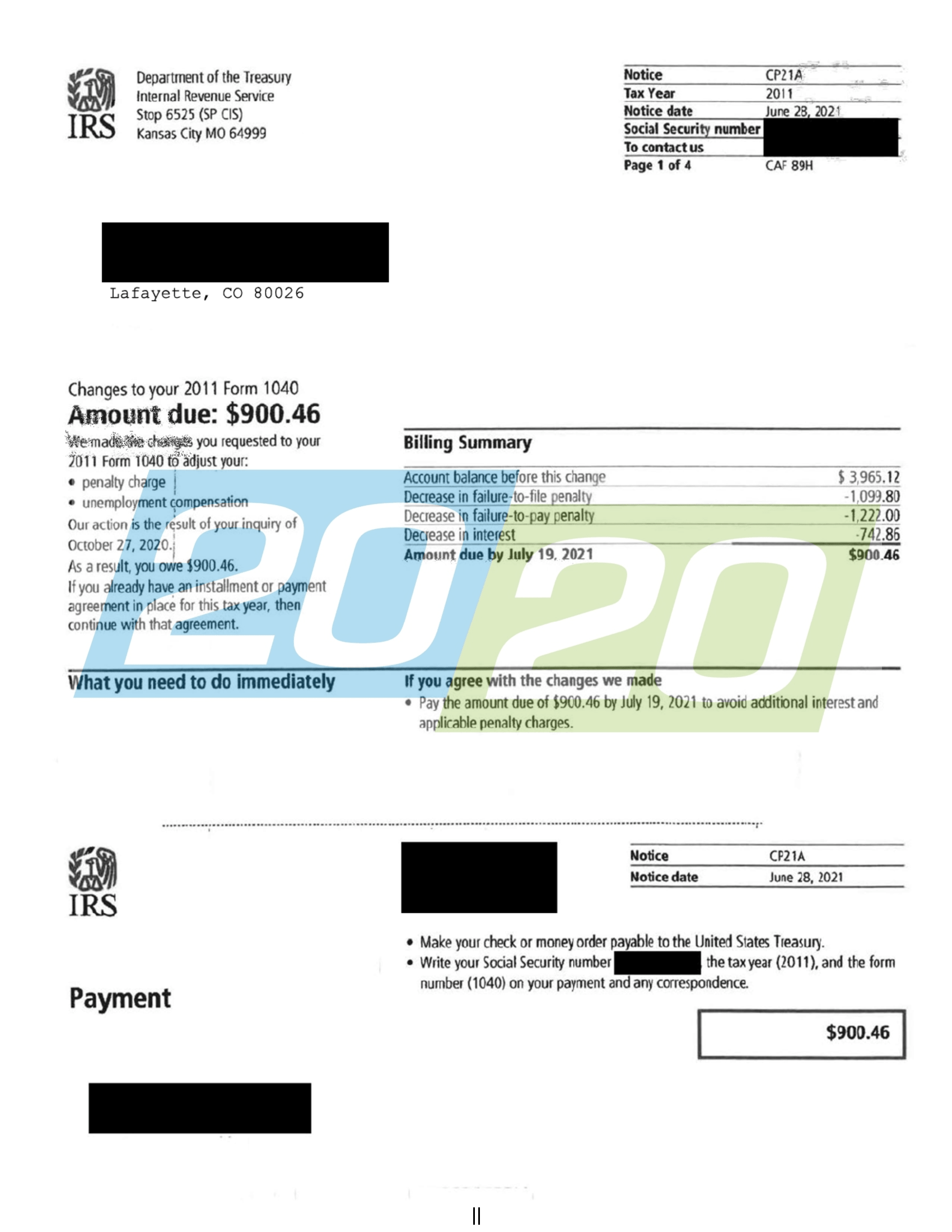

Tax Resolutions In Colorado 20 20 Tax Resolution

Explore Ski Vacations In Steamboat Springs Colorado

Tax Resolutions In Colorado 20 20 Tax Resolution

Alpenglow Village On The Horizon Apartment Communities Affordable Housing Village

House Renovation Project Plan Template Best Of House Project Plan Template Event Planning Template Event Planning Checklist Templates Event Planning Checklist

Steuben County Legislature Adopts 221 Million Budget Tax Changes

Tax Resolutions In Colorado 20 20 Tax Resolution

Tax Resolutions In Colorado 20 20 Tax Resolution

Tax Resolutions In Colorado 20 20 Tax Resolution

Tax Resolutions In Colorado 20 20 Tax Resolution

Craig S 2022 Sales Taxes Up Through First Three Months Of The Year Craigdailypress Com

Growth Of Summit County State Marijuana Sales Levels Off In 2018 Summitdaily Com

Tax Resolutions In Colorado 20 20 Tax Resolution

Englewood Beach Resorts Sea Oats Beach Club Englewood Beach Resorts Englewood Beach Beach Club Beach Resorts

Littourati Main Page Blue Highways Moscow Idaho Idaho County Idaho Travel Idaho Adventure